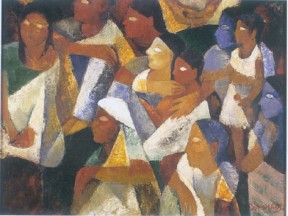

During the last India Art Summit held in Delhi this January, Bharti Kher’s untitled triptych made out of her trademark stick-on bindis reportedly fetched Rs 1.9 crore, slightly higher than husband Subodh Gupta’s acrylic on canvas that went for Rs 1.2 crore. Somnath Hore’s Congregation in a Village sold for Rs 75 lakh, a Ravinder Reddy lifesize bronze sculpture was picked up for Rs 95 lakh, while a smaller sculpture of four conjoined babies by Anant Kumar Mishra, titled How Gods were Born, was claimed to have been bought for a neat Rs 75 lakh.

During the last India Art Summit held in Delhi this January, Bharti Kher’s untitled triptych made out of her trademark stick-on bindis reportedly fetched Rs 1.9 crore, slightly higher than husband Subodh Gupta’s acrylic on canvas that went for Rs 1.2 crore. Somnath Hore’s Congregation in a Village sold for Rs 75 lakh, a Ravinder Reddy lifesize bronze sculpture was picked up for Rs 95 lakh, while a smaller sculpture of four conjoined babies by Anant Kumar Mishra, titled How Gods were Born, was claimed to have been bought for a neat Rs 75 lakh.

The final picture is pretty: the big names sold big, as expected, and even the not-so-famed artists reaped in the moolah. But this is not the complete picture, nor the entire truth of the Indian art market.

The vagaries of Indian art prices were driven home harder when during an art show, I chanced upon a gallerist friend haggling over the price of an upcoming artist’s work. The ‘potential’ buyer (the term before she becomes a ‘valued client’) was a nervous young thing, trying hard to bring the price down by 10-odd lakh. Several coffees and audible groans later, they settled the price with my friend still taking home a profit of a cool Rs 5 lakh! Then came the clincher: “Don’t disclose the actual price. If people believe this artist is worth much more, it will create a market for him,” grinned my friend, “art is also about status, you see.”

I am aware of several galleries who drop their ‘favourite’ artist the nanosecond they lose their ‘star’ status. On the other hand, many artists’ prices have skyrocketed after a random successful auction only to fall miserably in the jungle of the primary market. Very recently, a young artist, known for his horses painted as anatomical caricatures, had to break away from his mentor gallery. The reason, he said: “They were hiking my prices so much that I would have soon become unaffordable and I know I am not ready for such prices yet.” Very often, younger artists are projected to be selling at higher than the actual price (a publicist comes in handy here) to create a sense of “future investment” among aspirational buyers. With media obsession with the crore tag and million dollar ceilings that are being shattered every second day, prices seem to be the only artistic talking point in upscale living rooms.

Auction houses have done damage in their own way. While most buyers at such events are deep-pocketed collectors, any whimsical acquisition is seen as that artist’s rise to stardom and to unrealistic price points. Galleries begin to hoard the artist’s work, creating a false imbalance between demand and supply, pushing prices even further, as a new star gets created at yet another auction. In late 90s, a top gallery, which has now closed down, was reportedly hoarding works of artists like Nataraj Sharma, Dhruv Mistry, Chittrovanu Mazumdar and Manish Pushkale creating lack of supply in market and pushing prices up.

Auction houses have done damage in their own way. While most buyers at such events are deep-pocketed collectors, any whimsical acquisition is seen as that artist’s rise to stardom and to unrealistic price points. Galleries begin to hoard the artist’s work, creating a false imbalance between demand and supply, pushing prices even further, as a new star gets created at yet another auction. In late 90s, a top gallery, which has now closed down, was reportedly hoarding works of artists like Nataraj Sharma, Dhruv Mistry, Chittrovanu Mazumdar and Manish Pushkale creating lack of supply in market and pushing prices up.

Galleries are often found competing with each other to acquire senior artists whose prices they know will escalate after their death. A senior Delhi gallery reportedly bought all of Copenhagen-based artist Sohan Qadri’s new works though Qadri had been attached to another gallery for a longer period. With Qadri’s demise last month, the collection is being now publicised as the artist’s “last and priceless body of work”.

But are the blue-chip artists benefiting either? While it is a shame that most of the current auction heroes went unsung during their lifetime – Amrita Sher-Gil, Benode Behari Mukherjee, Ramkinkar Baij to name a few – even living veteran artists rue that none of the money comes their way from auction sales if the work has passed through many hands starting from the artist till this final sale.

Celebrity does not mean quality. And this should be the mantra for both buyers and collectors. As for artists, they should fix prices realistically and not be swayed by lure of instant stardom and media hype. The art market can be fixed only when gallerists and art dealers begin to maintain common rates as fluctuating prices at different places is harmful to the artist’s interest in the long run. While the grey market cannot be completely checked, prices can be monitored through a more informed infrastructure.

So whether you buy from an art gallery, which can offer a discount of up to 25-30 per cent to loyal customers, or directly from the artist, which saves you the 33 to 50 per cent commission a gallery keeps, make sure you are spending for the right reason. Buy art that is big on creativity and not commerce.

So whether you buy from an art gallery, which can offer a discount of up to 25-30 per cent to loyal customers, or directly from the artist, which saves you the 33 to 50 per cent commission a gallery keeps, make sure you are spending for the right reason. Buy art that is big on creativity and not commerce.